Automation

and

Data Integrity

Bringing advanced web analytics and automation to Wealth Management

The Wealth Management marketing team of an Investment Banking client had issues with tracking the performance of its web marketing activity. Their existing process was labour intensive, inflexible, and inaccurate.

Industry: Wealth Management

Challenges

Their existing data process was poor; extracting data from 3 different data sources. Analytic data was provided via a relatively inflexible reporting portal.

Manual data entry into excel/copy and paste was a key reason why the existing process was poor, in particular the manual aggregation of Google Analytics to Excel.

Manual reporting from 3 sources in PowerPoint, and manual download of pre-canned reports from their application stack introduced more errors.

And this is where the problem starts: it makes consolidation of data difficult; data is inaccurate; difficult to reconcile to other data sources and hard to discern a hierarchy.

Multiple users, no formal data model and a difficult data structure allowed data variations and inconsistencies.

Data Solution

Data Normalisation Service and Reporting Automation

- Create a process that can flexibly identify and normalise the data from long strings into a structured format

- Create an automated data process that feeds a dynamic dashboard

- Most importantly, ensure the accuracy of the data model and rules are kept up to date on an ongoing basis

The Data Model

We were able to benefit the client greatly from our data tagging experience. We created a structured data model and a rule set that would take all the client’s data variants and mapped them to the new data standards. But such tagging can’t be blind, it has to take context into account.

Automated Data Process

- API connections to Google (Search Ads 360; Display & Video 360; Campaign Manager) to remove the manual downloads

- Automated run of Calimere Point’s Data Model using our modern data analytics tools

- Output to a dynamic dashboard on a secure website

- The solution was deployable either on-premises within the clients infrastructure, or via the CPRA Cloud Platform

Regular Communications

- Turning off the tap of bad data: regular calls are scheduled to ensure data is on track and to give notice and agree the naming of new marketing activity.

- This is helped by Calimere Point’s automated data process that automatically extracts and highlights i) new data and ii) existing data that has changed.

- Data discipline gradually reduces the length of such calls as clients and agencies become more familiar with it. In the absence of this, the one-time cleaning was a waste of money.

Trustworthy data is a key element of business decision-making

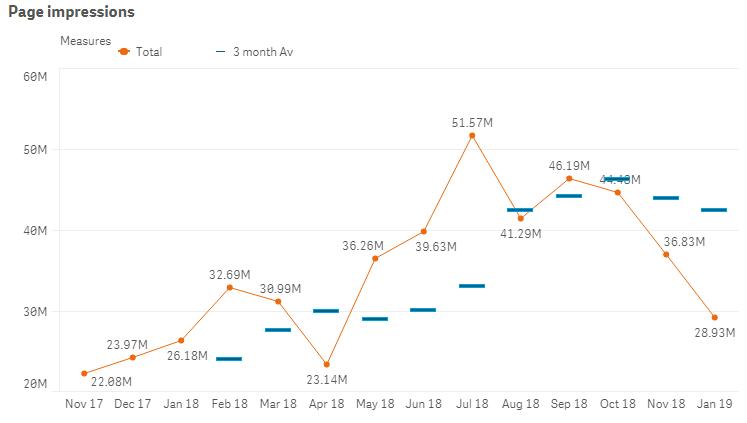

Providing flexible, easily accessible, and accurate marketing information on time.

More efficient use of spend; in one case a client’s marketing spend had to be diverted by their agency into crunching the (inaccurate) numbers.

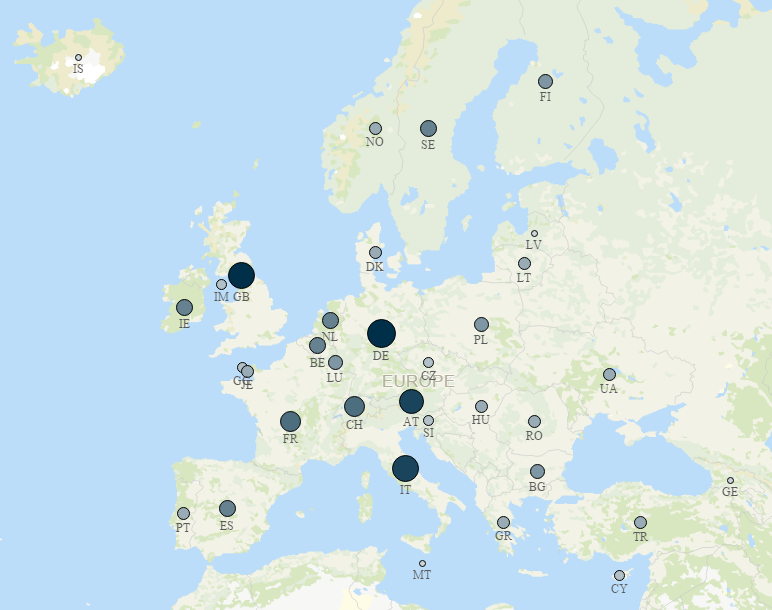

Transparency of marketing spend and marketing effectiveness. Provides accurate, timely information on the relative performance across regions, channels and formats.